In the vast and complex landscape of India’s cooperative and cooperative banking sectors, the Karimnagar District Central Cooperative Bank (DCCB) shines as a beacon of success, best practices and good governance. Established in 1921, the bank has weathered numerous challenges and emerged as a financial powerhouse, catering to the diverse banking needs of its customers.

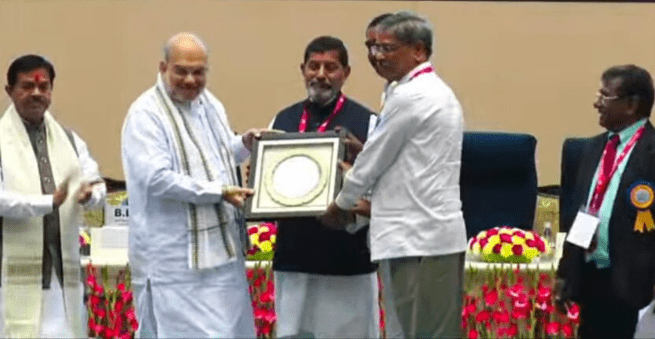

The Karimnagar District Cooperative Central Bank, which was reeling under acute financial crisis with losses to the tune of ₹70 crore during 2004-05 has today emerged as the best cooperative bank in the country, winning several national awards. The bank recently bagged the NAFSCOB’s all-India award for the seventh consecutive year in a row among all the 393 DCCBs in the country. Earlier, then NABARD Chairman said that the Karimnagar DCCB has emerged as a role model for all the cooperative banks in the country.

The journey of Karimnagar DCCB offers valuable lessons for other cooperative organizations in the country aspiring to replicate its remarkable achievements. The 2022-23 financial results of the bank supports its growth trajectory:

Financial Results:

During the financial year 2022-23, Telangana’s District Cooperative Banks collectively achieved a business of Rs 40,000 crore, with Karimnagar DCCB leading at Rs 5,625 crore. The Karimnagar bank achieved a growth rate of 14.79 per cent.

The bank reported a profit of Rs 91.40 crore for the same period, reflecting a notable increase from Rs 68.08 crore in 2021-22.

Gross Non-performing assets (NPA) reduced from 1.50% in 2021-22 to 1% in 2022-23, showcasing the bank’s financial resilience.

The KDCCB has set a targeted business of Rs. 7,000 Crores during the financial year 2023-24. The bank has also set a target of crop loan lending of Rs. 1,500 Crores during this financial year, while term loan of Rs. 300 crores, loans of Rs. 150 Crores to SHGs, educational loan of Rs. 100 crores, housing loans of Rs. 200 crores and other loans of Rs. 1,550 crores.

Chairman’s Perspective:

Konduru Ravinder Rao, KDCCB Chairman, expressed gratitude to customers for their trust. The bank’s growth rate of 14.79% and its initiatives in computerizing PACS and introducing a new HR policy for PACS have positioned it as a role model in cooperative banking.

The bank’s comprehensive approach includes supporting Primary Agricultural Cooperative Societies (PACS), providing financial assistance, capacity-building programs, and access to markets, significantly improving rural livelihoods.

As Karimnagar DCCB continues its upward trajectory, Chairman K Ravinder Rao aims for increased business, deposits, and net profit, while addressing challenges such as rising land values affecting deposit portfolios. The bank’s financial health, reflected in a CD Ratio of 141%, underscores its resilience and commitment to serving the community.

So, what sets Karimnagar DCCB apart in an environment where other district central cooperative banks struggle with inefficiency and financial losses?

Key factors behind Karimnagar DCCB’s success:

- Financial Inclusion: Recognizing its crucial role in empowering rural communities, the bank has proactively reached unbanked and underbanked populations, providing essential services like savings accounts, credit facilities, and insurance. This commitment to inclusive growth has not only fostered socio-economic development but also strengthened the bank’s own financial base and boosting deposit collection year by year.

- Member Engagement: Karimnagar DCCB understands its members are not just customers but stakeholders. Active engagement through regular meetings, workshops, and awareness campaigns ensures services and policies align with their needs, leading to greater satisfaction and loyalty.

- Technology Adoption: Embracing technology as a key driver of efficiency and transparency, the bank has invested heavily in core banking solutions, mobile banking platforms, and other digital initiatives. This has streamlined operations, improved customer service, and made transactions convenient.

- Professional Management: A team of highly qualified and experienced professionals manage the bank’s operations with prudence and foresight. The commitment to good governance is reflected in transparent financial reporting, strong internal controls, and adherence to ethical practices. This instills confidence among members and investors, solidifying the bank’s position as a reliable and trustworthy institution.

- Social Responsibility: Recognizing its responsibility towards the community, the bank actively participates in social development initiatives, focusing on education, healthcare, and environmental sustainability. This commitment has earned goodwill, strengthening the community bond. Recently the bank extended financial assistance of Rs 22.44 crore to 247 women self-help groups (Mahila Samakhya) of Sircilla textile town, further exemplifying its dedication to community development.

Dealing with NPAs:

Karimnagar DCCB adopts a proactive approach to NPA management, including:

- Early identification and intervention: Early warning systems identify potential NPA cases, and timely action prevents defaults.

- Restructuring and debt recovery: The bank offers loan restructuring options and works closely with borrowers to recover outstanding dues.

- Legal action: As a last resort, legal action is taken against defaulters to recover dues.

These measures have helped Karimnagar DCCB bring its NPA down to 1% in 2022-23 which is significantly low for cooperative banks.

National Context:

Karimnagar DCCB’s success story holds immense significance within the larger context of India’s more than 350 DCCBs as of 2023. By emulating its core principles and best practices, other cooperative banks can:

- Bridge the financial inclusion gap.

- Enhance member engagement and satisfaction.

- Leverage technology for operational efficiency and member convenience.

- Foster good governance and financial transparency.

- Contribute actively to social development and environmental sustainability.

Conclusion:

Karimnagar DCCB is not just a successful cooperative bank; it is a blueprint for success for the entire cooperative banking sector. By learning from its journey, adapting its best practices, and embracing its core values, other cooperative banks can unlock their true potential and contribute significantly to building a more inclusive, empowered, and sustainable India.